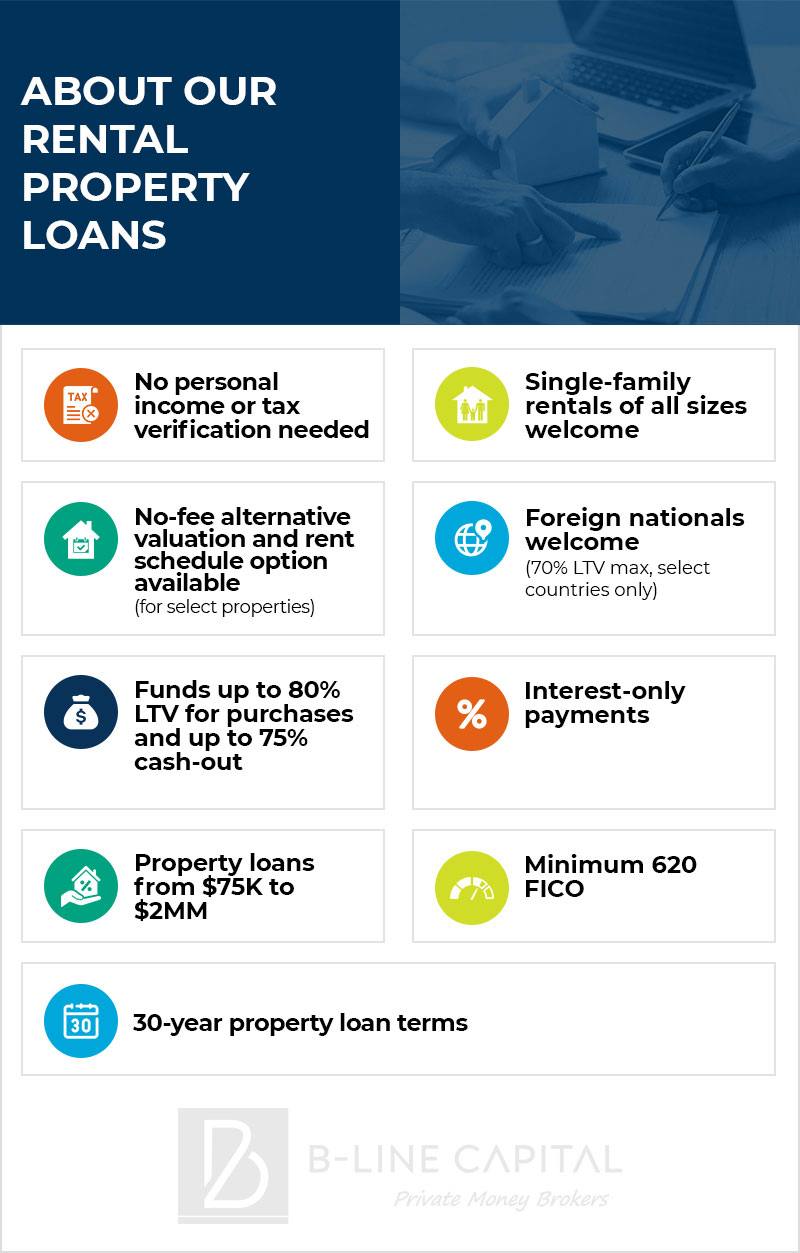

Rental Property/DSCR Loans

| LOAN PURPOSE | Options include: purchase, limited cash-out, or complete cash-out[3] |

| BORROWER | Individual or group |

| ACQUISITION MINIMUM | 1 rental property per loan |

| INTEREST RATE[1] | Rates as low as 6.5% |

| TERM | 30-year fixed |

| EXPERIENCE | No first-time homebuyers |

| MINIMUM CREDIT SCORE | 640 |

| MAXIMUM LOAN-TO-VALUE (LTV)[4] | 80% on purchase, 75% on cash-out[3] |

| MINIMUM LOAN AMOUNT | $75K-$2MM[13] |

| VACANCY MAXIMUM | Vacancy requires a max LTV of 60% |

| SEASONING REQUIREMENT | 180 days |

| RURAL PROPERTIES | Unqualified |

| FOREIGN NATIONALS |

|

| PROPERTY TYPES |

|

How a Oklahoma City, Oklahoma Rental Property Loan

Can Work for You

- Each one of your rental properties operates like an independent business. It isn’t affected by your other investments or personal financial history.[1]

- Each property is evaluated on its own and can leverage benefits accordingly.[9]

- We will thoughtfully advise and lead you through the entire process, answering all the questions you have along the way.